Gross Profit Formula - Definition, Examples, Quiz, FAQ, Trivia

Learn how businesses calculate profit with easy explanations and practice activities

What is Gross Profit?

Gross profit is the money a business makes after paying for the costs directly related to making or buying the products it sells. It's like when you sell lemonade at a stand: if you spend money on lemons, sugar, and cups, your gross profit is the money you make from selling lemonade minus what you spent on those ingredients.

Gross profit helps businesses understand how efficiently they're making and selling their products. It shows how much money is left to pay for other expenses like rent, salaries, and advertising.

To calculate gross profit, you need to know two important numbers: the total money from sales (revenue) and the cost of making or buying the products sold (cost of goods sold).

Key Terms

Revenue: The total money a business makes from selling products or services.

Cost of Goods Sold (COGS): The direct costs of producing or purchasing the goods sold by a business.

Gross Profit: The money left after subtracting COGS from revenue.

Gross Profit Formula

The formula for calculating gross profit is simple but very important for businesses:

Gross Profit Formula

This formula shows how much money is left after paying for the direct costs of products sold.

Revenue: This is all the money a business receives from selling its products or services. If a store sells 100 toys for $10 each, its revenue is $1,000.

Cost of Goods Sold (COGS): These are the direct costs of making or buying the products sold. For our toy store, if each toy costs $6 to make or buy, the COGS for 100 toys is $600.

Gross Profit: Using our formula: $1,000 (revenue) - $600 (COGS) = $400 gross profit.

Remember

Gross profit only includes the direct costs of products. Other expenses like rent, salaries, and marketing are subtracted later to find net profit.

How to Calculate Gross Profit

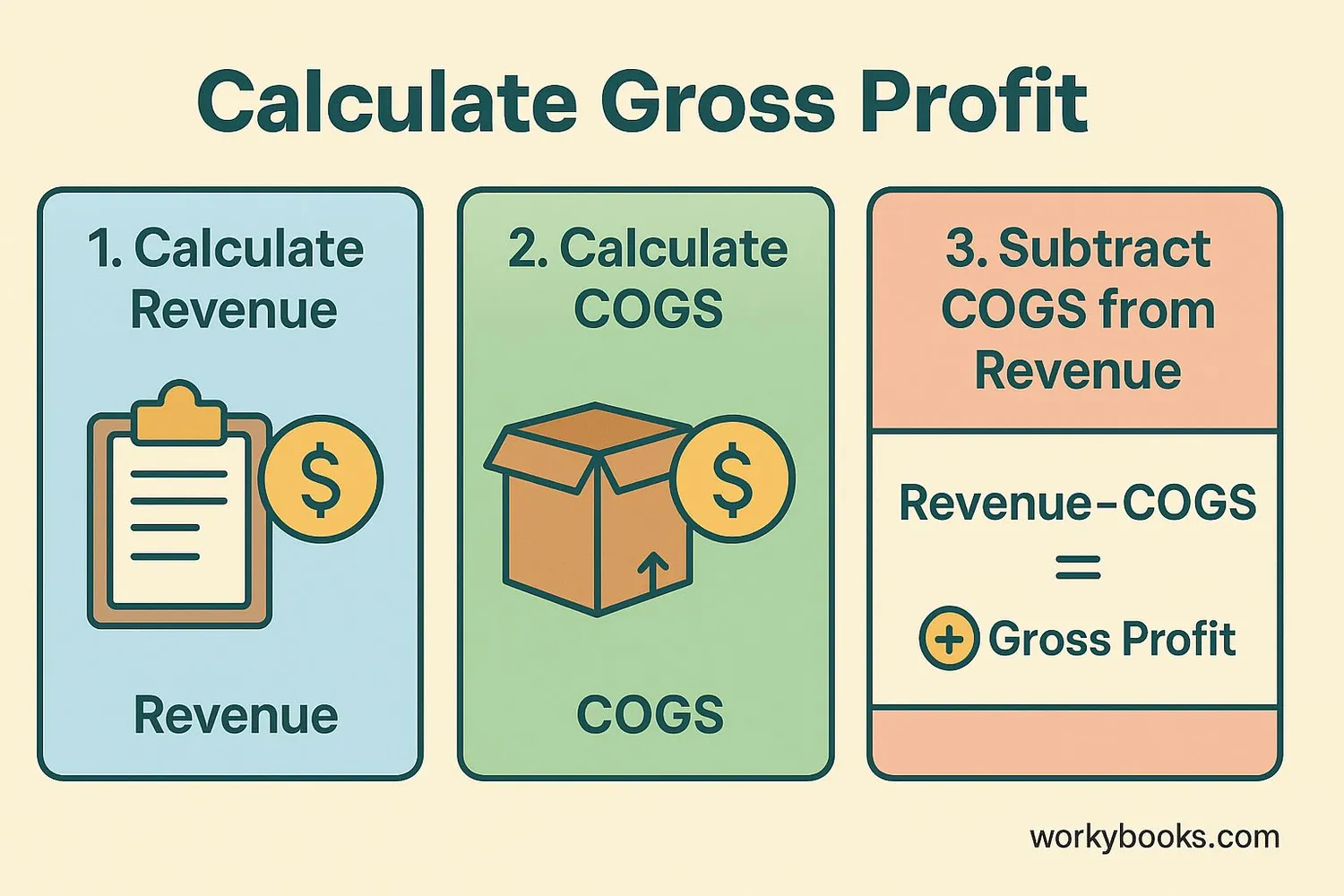

Calculating gross profit involves three simple steps:

Step 1: Calculate Revenue

Multiply the number of items sold by the selling price of each item.

Revenue = Number of units sold × Price per unit

Step 2: Calculate Cost of Goods Sold (COGS)

Multiply the number of items sold by the cost to make or buy each item.

COGS = Number of units sold × Cost per unit

Step 3: Calculate Gross Profit

Subtract COGS from revenue.

Gross Profit = Revenue - COGS

Let's practice with a simple example:

Maria sells 50 bracelets for $5 each. Each bracelet costs $2 to make.

Step 1: Revenue = 50 × $5 = $250

Step 2: COGS = 50 × $2 = $100

Step 3: Gross Profit = $250 - $100 = $150

Maria's gross profit is $150. This is the money she has to pay for other expenses and keep as profit.

Calculation Tip

Always make sure you're using the same number of units for both revenue and COGS calculations.

Real-World Examples

Let's look at some examples of gross profit calculation in different situations:

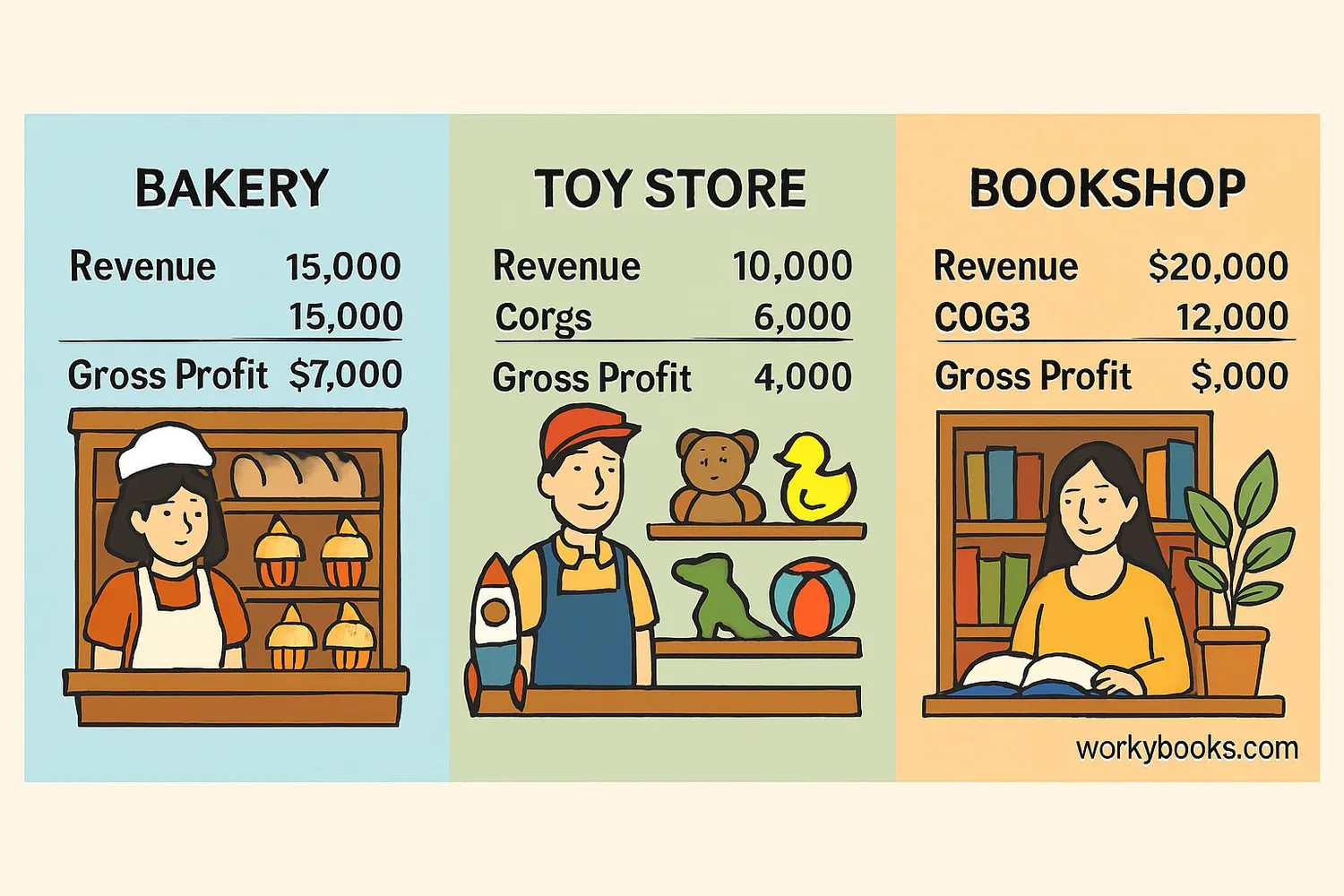

Example 1: Bakery

A bakery sells 200 loaves of bread at $4 each. Each loaf costs $1.50 to make.

Revenue = 200 × $4 = $800

COGS = 200 × $1.50 = $300

Gross Profit = $800 - $300 = $500

Example 2: Toy Store

A toy store sells 75 toy cars at $12 each. The store bought each car for $7.

Revenue = 75 × $12 = $900

COGS = 75 × $7 = $525

Gross Profit = $900 - $525 = $375

Example 3: Bookstore

A bookstore sells 40 books at $15 each. The bookstore bought each book for $9.

Revenue = 40 × $15 = $600

COGS = 40 × $9 = $360

Gross Profit = $600 - $360 = $240

Practice Tip

Try creating your own examples with different products and prices to practice the calculation.

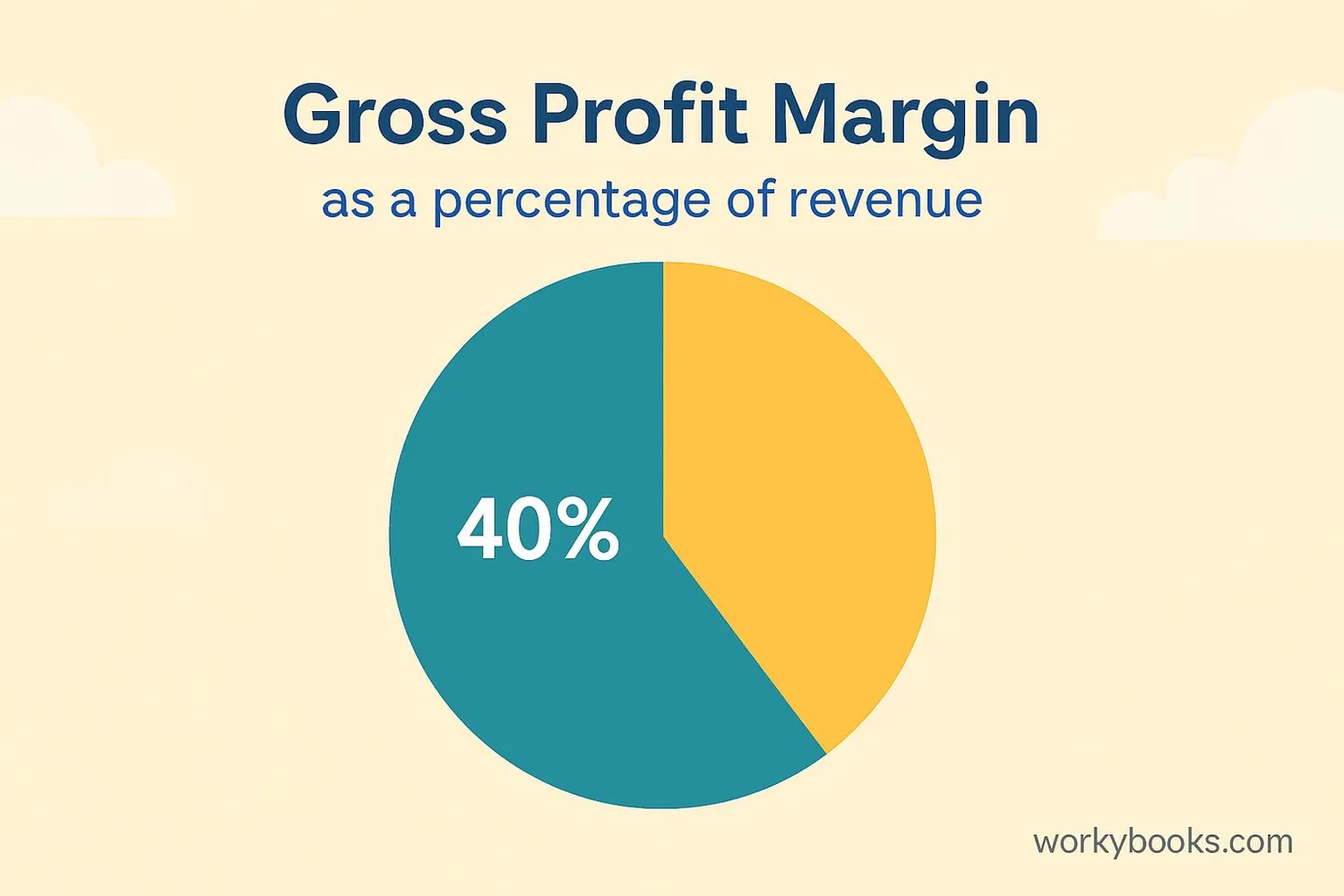

Gross Profit Margin

Gross profit margin is a percentage that shows how much of each dollar of revenue is gross profit. It helps businesses compare their performance over time or with other businesses.

The formula for gross profit margin is:

Gross Profit Margin Formula

This formula shows the gross profit as a percentage of revenue.

Maria's revenue was $250 and her gross profit was $150.

Gross Profit Margin = ($150 ÷ $250) × 100 = 60%

This means for every dollar Maria makes from selling bracelets, 60 cents is gross profit.

Now let's calculate the gross profit margin for our other examples:

Bakery: ($500 ÷ $800) × 100 = 62.5%

Toy Store: ($375 ÷ $900) × 100 = 41.7%

Bookstore: ($240 ÷ $600) × 100 = 40%

The bakery has the highest gross profit margin at 62.5%, which means it keeps more of each dollar as gross profit compared to the other businesses.

Margin Tip

A higher gross profit margin is generally better because it means the business keeps more money from each sale after paying direct costs.

Practice Quiz

Test your understanding of gross profit with this 5-question quiz. Choose the correct answer for each question.

Frequently Asked Questions

Here are answers to common questions about gross profit:

Business Trivia

Discover interesting facts about business and profit:

Oldest Business

The oldest company still operating is Kongō Gumi, a Japanese construction company founded in 578 AD. That's over 1,400 years of calculating gross profit!

Lemonade Stand Economics

The average lemonade stand makes about $15-20 in revenue per day. With typical costs, that's about $8-12 in gross profit. Many successful businesspeople started with lemonade stands!

Profit Margins Vary

Different industries have very different typical gross profit margins. Software companies often have margins over 80%, while grocery stores might have margins under 30%.

Global Business

The world's largest company by revenue is Walmart, with over $500 billion in annual revenue. Even a small change in their gross profit margin would mean billions of dollars!