16th Amendment: Federal Income Tax Established — Reading Comprehension

Premium Resource

Grades

- 6

- 7

- 8

Standards

- D2.HIS.2.3-5

- D2.HIS.3.3-5

- RI.6.3

- RI.6.4

- W.6.2

PRINT+DIGITAL RESOURCE

This learning resource is available in interactive and printable formats. The interactive worksheet can be played online and assigned to students. The Printable PDF version can be downloaded and printed for completion by hand.

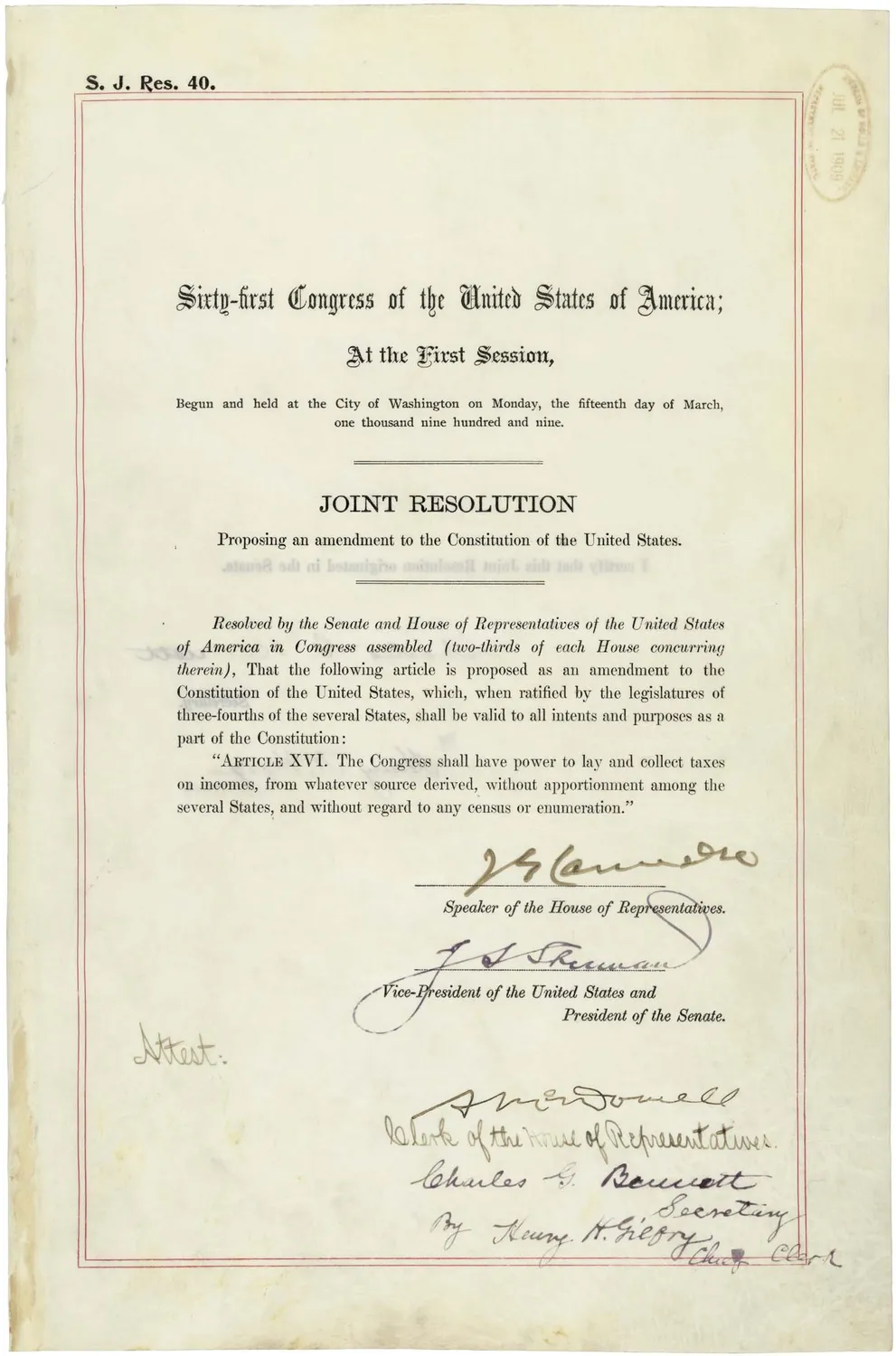

About This Reader

This passage explores the causes, debates, and consequences of the 16th Amendment, which established the federal income tax in the United States. Students will analyze the historical context of early 20th-century America, examine multiple perspectives on taxation, and consider the amendment’s long-term effects on government and society. The reading passage models historical reasoning, features a primary source excerpt, and includes a glossary of key vocabulary. Activities include a multiple-choice quiz, writing prompts, a T-chart graphic organizer, and a timeline. This resource aligns to C3 Framework and Common Core standards and features read aloud audio and a full Spanish translation, making it ideal for diverse learners interested in U.S. history and civic development.

Perfect For:

👩🏫 Teachers

- • Reading comprehension practice

- • Auto-graded assessments

- • Literacy skill development

👨👩👧👦 Parents

- • Reading practice at home

- • Comprehension improvement

- • Educational reading time

🏠 Homeschoolers

- • Reading curriculum support

- • Independent reading practice

- • Progress monitoring

Reading Features:

📖

Reading Passage

Engaging fiction or nonfiction text

❓

Comprehension Quiz

Auto-graded questions

📊

Instant Feedback

Immediate results and scoring

📄

Printable Version

Download for offline reading

🔊

Read Aloud

Voice-over with word highlighting